This information should not be interpreted as financial, tax or legal advice. Mortgage and loan rates are subject to change.

epc

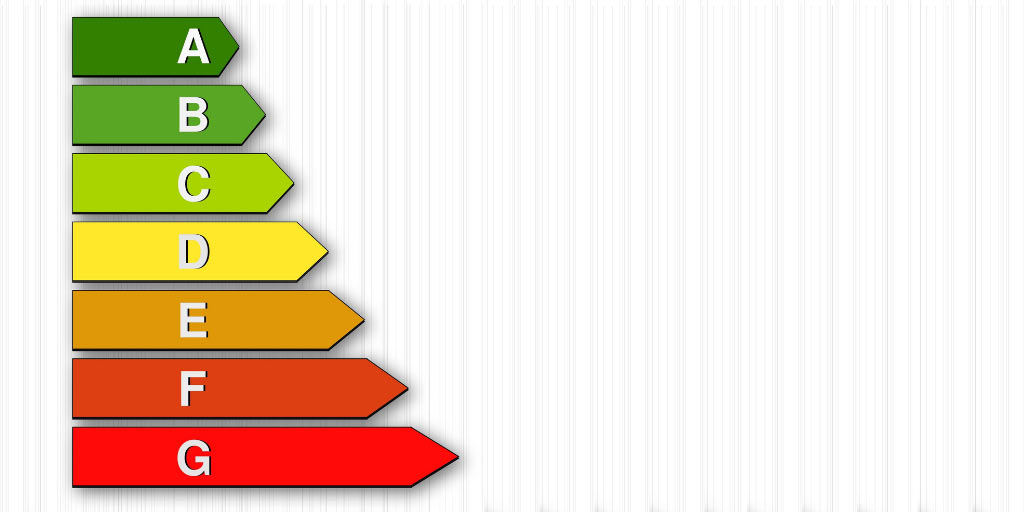

epcA quarter of buy to let properties are rated D or below for energy according to UK lender Shawbrook Bank.

Energy performance challenge

A new report from Sharbook Bank titled ‘Confronting the EPC Challenge’ contains data from a survey of over 1,000 landlords.

The results may be rather surprising, as 27% of the landlords who responded admitted to not knowing the Energy Performance Certificate (EPC) rating of their property.

The incoming EPC changes have been a hot topic of late, as the UK Government is requiring all PRS properties to have a minimum rating of C or above by 2025 for all new tenancies.

The deadline for existing tenancies is a little further ahead in 2028, but upgrades can be difficult to make with tenants in situ.

Some landlords, with older properties, are concerned about the leap they will have to achieve with their properties. The report reveals that two in ten landlords do not have the necessary funds to start the refurbishments their properties will require.

The English Housing Survey, published in December, found that there has not been an increase in energy efficiency among housing stock in the PRS over the last year, despite the deadline moving closer.

Landlords wanting support

One overarching theme of the report is that landlords feel they need more support with the EPC changes.

A third of landlords surveyed called for guidance on timings, on how to phase the implementation of changes.

29% wanted to see signposting to suppliers, who could help them make improvements to their properties.

Landlords who are proactively making changes are facing hurdles ultimately attributable to the pandemic, with labour availability scarce and some suppliers unable to assist with the changes required.

Almost 30% wanted to receive guidance on how to manage tenants during the improvement process.

37% of respondents want to see incentives to make changes such as favourable borrowing rates.

These favourable borrowing rates are already starting to be seen in the market, but are for high EPC ratings of A or B, rather than the C that is required by these regulations.

Environment impact

Emma Cox, Shawbrook Bank sales commented on the release of the report and the steps that will be needed to support landlords moving forward:

“Improving the energy efficiency of properties is a vital step in reducing our impact on the environment, however, this will not necessarily be a straightforward process for landlords. The UK has a significant proportion of older properties that are particularly challenging to improve, and many landlords remain in the dark as to their properties’ current ratings.

“Landlords will require further support from both the industry and the government in order to make the changes in good time. Indeed, with the cost of labour and supplies rising, it could be a costly exercise for all landlords, but there are solutions available.

“It is in everyone’s interest that properties are made more energy efficient, however this cannot be done half-heartedly, and we must ensure sufficient resources are provided so that landlords can make the appropriate changes to benefit their properties and their tenants.

“We hope that our forthcoming working group provides a space for landlords and the wider industry to share ideas and solutions to confront this challenge, and we look forward to sharing the findings in the coming weeks and months.”